172 Doncaster Road, Balwyn North comprises two interconnecting brick buildings with multi-storeyaccommodation including lobby, office, meeting rooms, kitchen facilities, restrooms and storage. Theproperty has on...

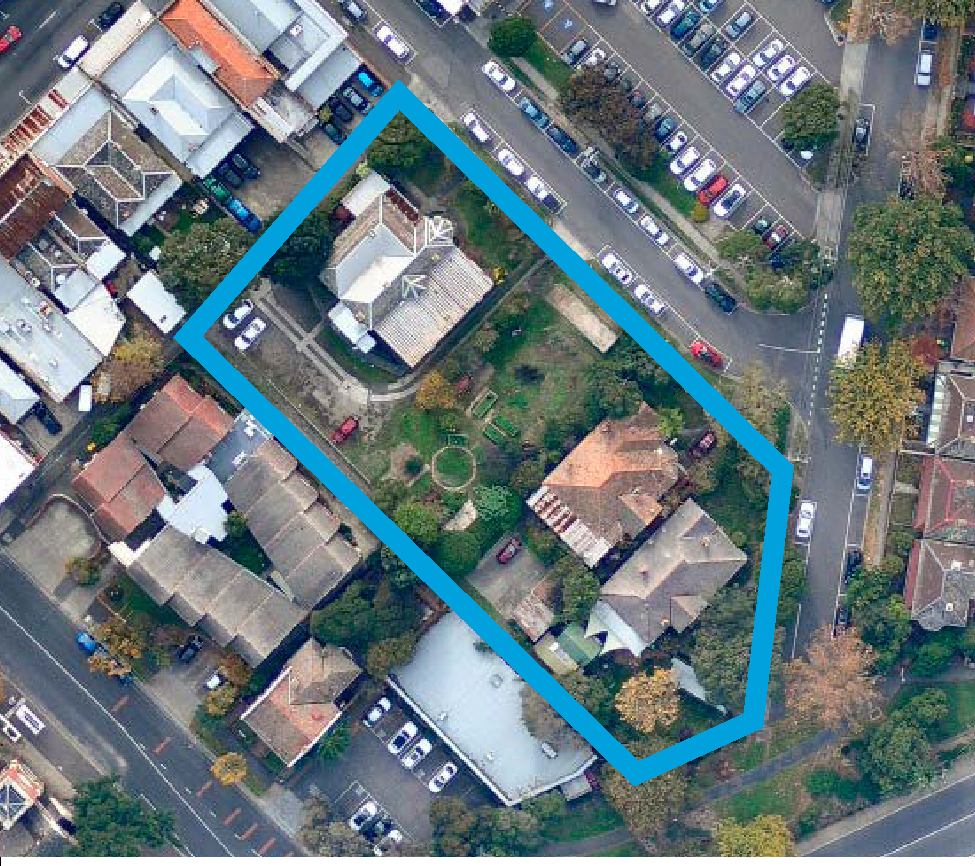

1542-1544 High Street Glen Iris is a substantial landholding of approx. 1,700sqm on two titles, suitable for residential development, landbank investment, medical or childcare uses...

This is a rare opportunity to continue use as a restaurant or fully refurbished office, in a great location close to Caulfield Junction. Zoned Commercial...

Fully refurbished building offering four levels of office space plus a separate rear office warehouse and onsite allocated parking in the heart of the Monash...

A tenanted double storey corner office building with value-add potential, 349 Moray Street South Melbourne was an astute investment opportunity to a discerning purchaser. This...

Sydney-based boutique developer Fortis has stepped up its interstate expansion with the purchase of 34 Eastern Road, South Melbourne – a 2-level vacant office building....

The sale of 627 Chapel Street South Yarra to another local residential developer Goldfields reflects a substantial short-term capital gain for Fridcorp, which bought the...

A prominent campus style office park constructed in 1991 comprising 20,000sqm of commercial accommodation over three separate office buildings with ample car parking and planning...

Melbourne Acquisitions is pleased to announce the sale of 349 Moray Street, South Melbourne. The commercial asset sold via private sale for $2.6 million and was...

Melbourne Acquisitions together with Allard Shelton were proud to offer an exciting opportunity being 106 Greville Street, Prahran to the market. Known for its young and trendy lifestyle,...